Automate how you collect & store

IRS Form W-9getW9

A secure & easy system!

START FREE TRIAL WATCH DEMO

Save Time & Headaches!

How it Works

1. Create a W-9 request

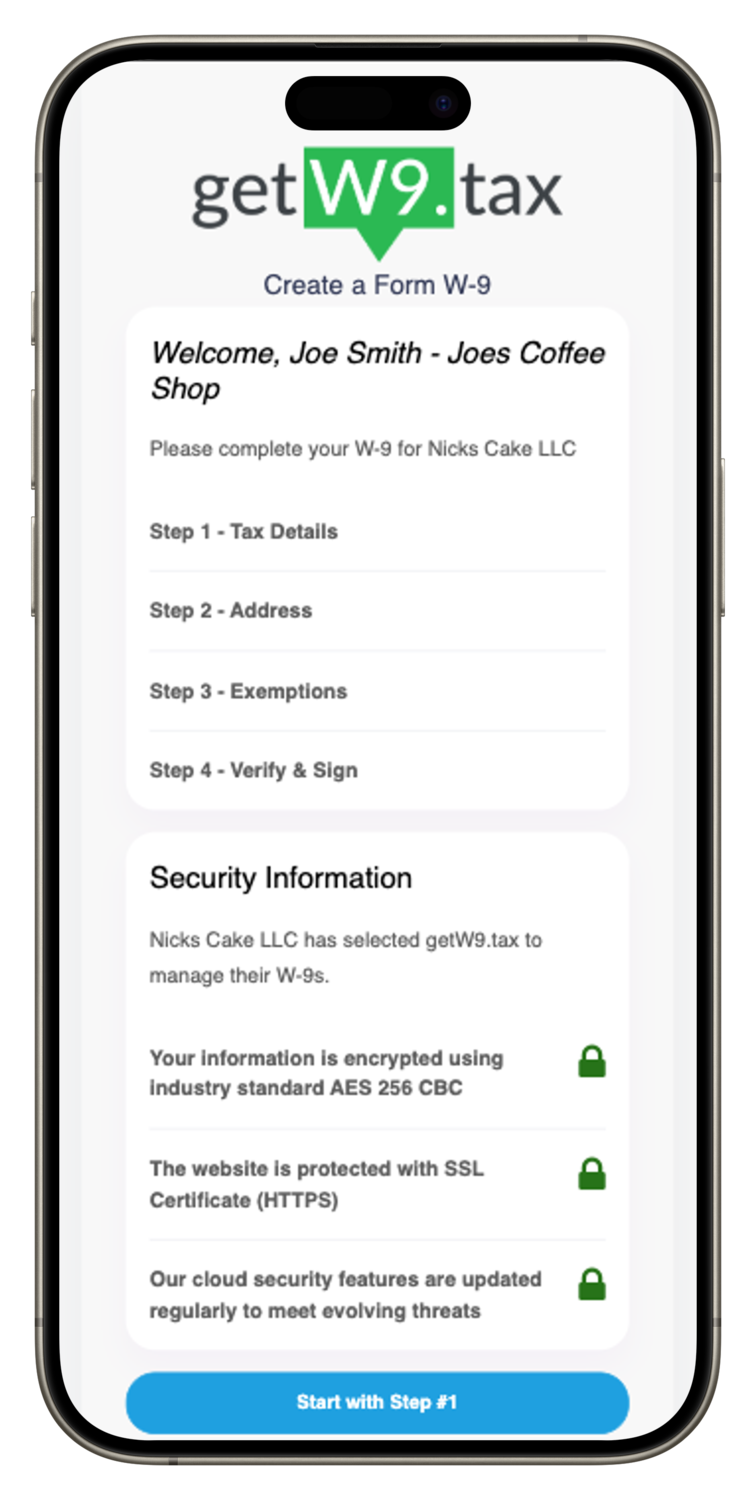

2. Vendor/contractor receives a secure link

3. Once the W-9 is filled out online, a PDF & all details are stored in your getW9 account.

Giga plan users can share a unique & secure link directly on their website or emails, through which W-9s can be created & submitted. You don't need to worry about printing or scanning in W-9s!

Key Features

Developed by a practicing

CPA

that gets

the frustrations of getting W9 forms!

Web‑based & User‑friendly

Fully cloud‑based and easy to learn & use — no software to install.

Secure

Your data is encrypted using industry standard AES-256 encryption.

QuickBooks® Online Integration

Sync with QBO and automate vendor W-9s!

USPS Address Validation

USPS‑standardized addressing helps catch typos and missing units, helping reduce undeliverable or returned mail and prevent 1099 filing delays.

Automatic Reminders

So you don't have to keep reminding your contractors or vendors, our system will keep bugging them!

Budget Friendly

With a digital Form W-9 process you'll save money on paper, ink & also time & headaches! P.S. we're way cheaper than IRS penalties!

Start a 7 day risk-free trial!

Pricing Plans (4 to choose from)

7 day risk-free trial included with all plans

Giga

- Request & store unlimited W9s

- Securely share your own W-9(s)

- Add up to 2 other users

- Add unlimited companies

- W-9 PDFs are stored online

- Automatic reminders

- QuickBooks® Online Sync

- Bulk upload W-9 requests via Excel

- Export data for year end 1099s

-

★ Override Contact Info in W-9 Requests Giga Exclusive

-

★ Receive W9s via a Shareable Link Giga Exclusive

-

★ USPS Address Validation Giga Exclusive

FAQs

We take data security very seriously. Your information and data is encrypted using industry standard AES-256 CBC encryption, which is the highest level of encryption.

Per the IRS, anyone who is required to file an information return (i.e. 1099 forms) with the IRS must obtain the correct taxpayer tax IDs from the person whom they paid. For example, if you hired an independent contractor (IC) and paid them $2,000 in the past year, then that IC would need to provide you with a Form W-9, so that you can correctly file an information return (1099) with the IRS and also send a copy of the 1099 to the IC.

We make it easy to collect & store your Form W-9s, by automating the whole process. Once you've created a Form W-9 request from on of your vendors/contractors, the system will keep sending reminders until they've filled out the W-9 online. Our system will also let you securely share your own Form W-9s with anyone that requests one from you via a secure link. Also, the getW9 portal saves all the W-9s received and also lets you export the data needed to prepare 1099s.

Once you've logged into your account, you can start a W-9 request by entering a few details about the person/company from whom you need a W-9, and then the system will send out an email or text with a secure link for the person to fill out a Form W-9 online. Once they've filled out the W-9, a copy of along with all the relevant data will be saved to your getW9 account. You can view the W-9s at anytime. Also, at year end you can easily export the W-9 data to help you prepare 1099s. You don't need to worry about printing or scanning in W-9s.

Yes! You can invite your accountant or bookkeeper as a 3rd party user, so they can run reports and export any necessary data they need to help you. You can also revoke their access at anytime.

Inside your getW9 dashboard you have the option to integrate each of your companies/organizations to their respective QBO account. Once the integration is setup, there are two ways the sync will work. #1). Anytime a new vendor is added to QBO with an email address, getW9 will pull that vendor's information and send them an automatic request to fill out their Form W-9 online for you. Once they have filled out their W9, the data & PDF will be stored in your getW9 account, and getW9 will update the vendor profile in QBO with all the details, tax ID, etc., and also attach a PDF of the W9 to their vendor profile in QBO. #2). The other way the QBO sync works is, if you request a W9 through getW9, and the vendor fills it out and submits it back to you, then getW9 will go into QBO and create a new vendor for you and add all their details and also a copy of the W9 pdf.

Yes! We offer an affiliate/referral partner program in which anyone can earn a 15% referral commission on any signups that result from their referral link. Learn more about our affiliate/referral program here.

You can visit www.irs.gov/FormW9 for instructions and the latest information. Click here for a blank fillabe PDF of the W9.

GIGA plan users get USPS address validation built in. After a vendor enters an address and clicks Save & Proceed, a confirmation shows two choices: Use Entered Address & Continue or Use USPS Address & Continue (standardized by USPS). On the Signature step, the vendor sees a USPS status badge (Validated or Failed). Admins also see a USPS Address audit indicator in the Vendor W-9s Received dashboard. Using USPS‑standardized addressing helps reduce undeliverable or returned mail and 1099 delays. Learn more.