Physical Address

5206 Hwy 5 N Suite 100, Bryant, AR, United States, Arkansas

Physical Address

5206 Hwy 5 N Suite 100, Bryant, AR, United States, Arkansas

January 31 doesn’t sneak up on anyone.

Yet every year, finance teams still end up in the same place:

The truth is, most 1099 chaos doesn’t start in January. It starts in December, when W-9s are “something we’ll deal with later.”

This time, you can do it differently.

In this guide, we’ll walk through early 1099 prep a simple, practical process you can start in the first week of December to stop the January W-9 scramble before it begins. You’ll learn how to clean your vendor list, find the W-9 gaps, standardize the way you collect forms, and use automation tools like GetW9 to take the manual chasing off your plate.

If you’ve ever spent the last week of January sending “Hi, quick W-9 reminder…” emails at 9 p.m., you already know the cost of waiting.

When you delay 1099 prep until mid-January:

The result?

Early 1099 prep flips the script. Instead of reacting to the deadline, you:

Ask yourself:

Early 1099 prep is not a massive new project. It’s a smarter way to use a few hours in December so January becomes calmer, more predictable and far less dependent on frantic inbox searches.

You can’t prepare accurate 1099s if you don’t know who your potential 1099 vendors are.

The first step in effective early 1099 prep is to clean up your vendor list.

Start by exporting your vendors from your accounting or bookkeeping system (QuickBooks, Xero, etc.). Then, filter that list down to the vendors who are most likely to need a 1099:

From there, create a simple 1099 candidate list that includes:

You don’t have to be perfect or deeply technical here. The goal is to move away from “we’ll figure it out later” and toward “we know which vendors are on our radar.”

If you use QuickBooks, you can connect it to GetW9 to auto-import your vendors instead of maintaining a separate spreadsheet. That makes early 1099 prep easier every year.

Getting this list right is the foundation. Everything else in your early 1099 prep process becomes simpler once you know who you’re dealing with.

Once you have your 1099 candidate list, the next question is simple:

Which of these vendors are missing a valid W-9?

This is where early 1099 prep really starts to save you time.

A W-9 might be:

For your 1099s to be accurate, you need current, complete W-9s from each vendor that will receive a form.

If you need a refresher on what the form actually covers, refer back to our guide: What is a W-9 form?

Take your 1099 candidate list and add a simple status column such as:

This gives you an instant view of:

Ask yourself:

Early 1099 prep is about surfacing those gaps in December, when you still have time to fix them without panic.

Most of the pain around W-9s doesn’t come from the form itself. It comes from inconsistent processes.

If every W-9 request is a one-off email, sent from a different person, with a different message and a different place to store the form… chaos is guaranteed.

Early 1099 prep gives you the chance to fix that.

Create one clear W-9 request template your team will use for every vendor. It should:

Decide on one destination for completed W-9s:

The key is that your team knows exactly where W-9s are collected and where they can be found later.

Manually following up with vendors is what turns W-9 collection into a January nightmare.

Instead, use automation to:

This is where a tool like GetW9 shines:

Automation doesn’t replace your judgment but it does replace dozens of manual follow-ups and ad-hoc email chains.

The best part about early 1099 prep is that once you design the process, you can reuse it every year.

Instead of reinventing your approach each January, turn it into a playbook.

Write down how your 1099 workflow should run. For example:

Make sure everyone knows:

If someone leaves the team or changes roles, your early 1099 prep doesn’t have to start from scratch. The playbook lives on.

After 1099 season, take 15–20 minutes to review:

Small improvements each year turn early 1099 prep into an asset, not a headache.

You can do everything above with spreadsheets, shared folders, and manual emails. But if you’d rather take the admin out of early 1099 prep, this is exactly what GetW9 was built for.

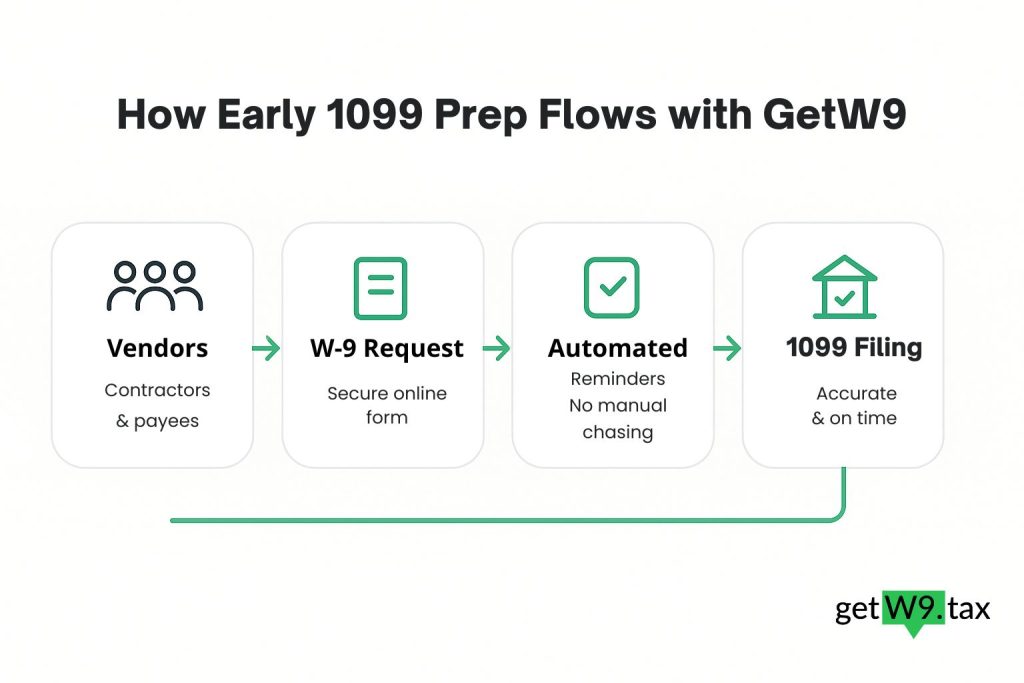

Here’s how GetW9 supports each step:

(If you use QuickBooks, you can connect it to GetW9 to auto-import vendors instead of exporting CSVs.)

With GetW9 in place, early 1099 prep becomes much lighter. You still own the process but the tool takes care of the repetitive, administrative work that usually burns time and attention in January.

To recap, effective early 1099 prep comes down to a few simple moves:

Start this early 1099 prep in the first week of December, and January 31 becomes just another date on the calendar not a crisis.

Ready to take the manual chasing out of W-9s?

Start your free GetW9 trial on getw9.tax and send your first batch of W-9 requests in minutes.

Already using GetW9?

Log in and set up your “1099 Prep – December” campaign so your January is calmer from day one.

Disclaimer: This article is for general information only and does not constitute legal or tax advice. Always consult your tax advisor or legal counsel for guidance specific to your situation.