Physical Address

5206 Hwy 5 N Suite 100, Bryant, AR, United States, Arkansas

Physical Address

5206 Hwy 5 N Suite 100, Bryant, AR, United States, Arkansas

Not legal advice. This guide is for general information to help businesses collect Form W-9s efficiently.

Vendors usually don’t ignore you on purpose. They’re busy, unsure what to do, or uncomfortable sharing sensitive information by email. The fix:

Timing

Replace bracketed fields (e.g.,

[Vendor Name]) and insert your secure GetW9 link where shown.

Subject options:

Body:

Hi [Vendor Name],

To keep our 1099 records accurate, we need your completed Form W-9.

Please use this secure link to submit it online: [Secure W-9 Form Link].

Why this matters: This helps us correctly report payments and avoids future notices.

Deadline: Please complete it by [Date]. It should take under 2 minutes.

If you have questions, just reply to this email, we’re happy to help.

Thank you,

[Your Name]

[Title], [Your Company]

Subject options:

Body:

Hi [Vendor Name],

Just a friendly reminder about the W-9 we requested.

Please submit it by [Date] using our secure form: [Secure W-9 Form Link].

If you’re unsure what a W-9 is, or who should complete it, reply here I’ll guide you.

Thanks for your help,

[Your Name]

Subject options:

Body:

Hi [Vendor Name],

This is a final reminder to submit your Form W-9 by [Date] using our secure link: [Secure W-9 Form Link].

Without a current W-9, our records may be incomplete, and it can affect year-end reporting.

If you have any trouble, reply to this email and I’ll help you through it.

Thank you,

[Your Name]

Before you start

During the week

After collection

Manual follow-ups cost hours and increase risk. Here’s a simple automation play:

Result: Less chasing, fewer errors, faster 1099 close.

Do I need a W-9 from every vendor?

You generally need a W-9 from U.S. vendors you may report on a 1099. If unsure, collect it at onboarding—then you won’t scramble later.

When should I collect a W-9?

At vendor onboarding before first payment, or as soon as you add them to your system.

Can a vendor email me their W-9?

Avoid email. It’s not ideal for sensitive information. Use a secure form link (e.g., GetW9) and keep records centralized.

What is name/TIN validation?

A check that the vendor’s legal name and TIN appear to match, helping reduce IRS mismatch notices (CP2100) later.

What if a vendor refuses to submit a W-9?

Explain why it’s required for your records and year-end reporting. If they still decline, consult your tax advisor on next steps.

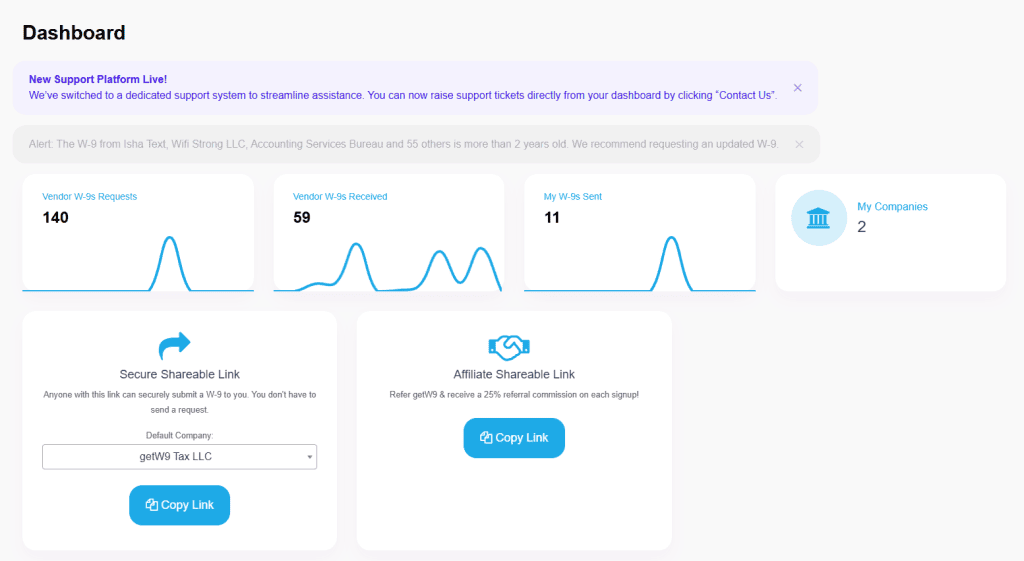

Collect W-9s with a clear plan, then hand off the repetitive work to automation.

Next step: Start collecting W-9s securely and save tamper-evident PDF records with a submission history all in one place with GetW9.