Physical Address

5206 Hwy 5 N Suite 100, Bryant, AR, United States, Arkansas

Physical Address

5206 Hwy 5 N Suite 100, Bryant, AR, United States, Arkansas

If you can’t answer this in 10 seconds…

“Which vendors are missing a W-9 right now?”

…you’re not “a bit behind.” You’re exposed.

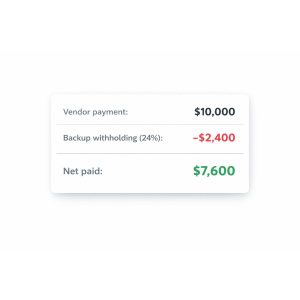

Because in certain situations, the IRS can require you (the payer) to withhold 24% from future payments. That’s backup withholding and it’s one of the fastest ways to turn a normal vendor payment into a messy compliance problem.

This guide breaks down:

Not tax advice. This is operational guidance. For filing specific decisions, talk to your CPA.

Backup withholding is when the payer must withhold tax at the current rate of 24% from certain reportable payments in specific cases (often tied to missing/incorrect taxpayer info).

The business reality:

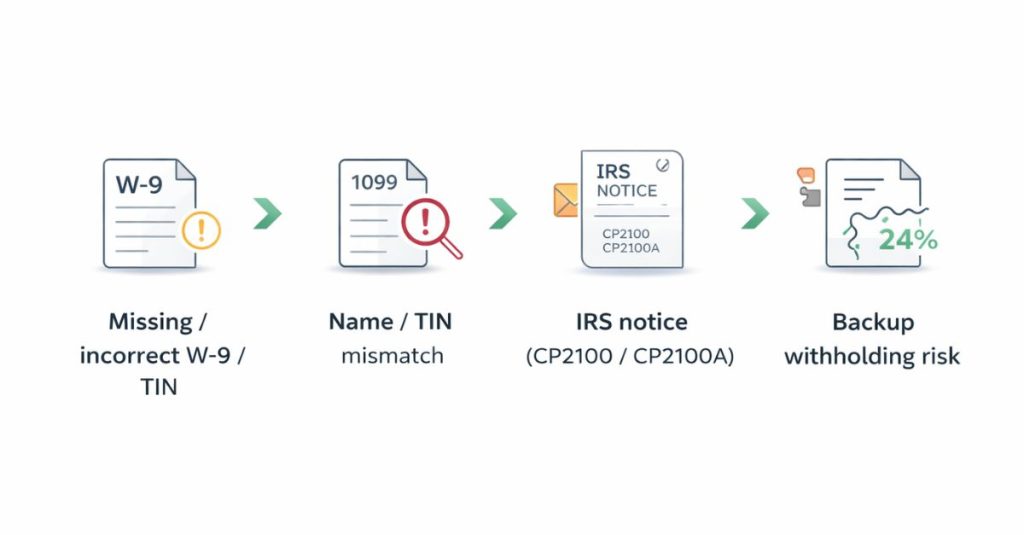

Most of the time, it’s not because you “did something wrong on purpose.” It’s because your Name/TIN and W-9 process isn’t tight.

Common trigger patterns include:

If you file information returns with missing/incorrect Name/TIN combinations, the IRS may send a CP2100 or CP2100A notice telling you to correct the issue and follow backup withholding procedures.

Two operational details that matter:

If your vendor data is scattered across inboxes and spreadsheets, responding to these becomes painful.

You’ve basically told yourself: “We’ll remember later.” You won’t especially at scale.

Vendor data is split across:

That’s how mismatches are born.

“In someone’s inbox” is not storage. It’s future failure.

As of the IRS’s 2026 Employer’s Tax Guide (Publication 15), the backup withholding rate remains 24%.

Publication 15 (2026) states that for reportable payments under IRC 6041(a) or 6041A(a) that are made in calendar year 2026 and subject to backup withholding, a new law raises the aggregate reportable payment threshold from $600 to $2,000, and it will be inflation-adjusted after 2026. IRS

Here’s what not to do:

Don’t treat this as permission to get lazy about W-9s.

Why?

If anything, this makes clean intake more important, because teams will be tempted to “ignore small vendors,” and that’s how your data integrity collapses.

Right now, the currently published Form W-9 is Rev. March 2024.

But the IRS released a draft of a revised Form W-9 with a January 2026 revision date, largely reflecting:

Practical takeaway:

If your company uses a “saved” W-9 PDF template, vendor onboarding packet, or an embedded form on a portal plan to review/update it when the final 2026 W-9 is released.

Form W-9 is used to provide the correct TIN to a requester who may need to file an information return.

So stop paying vendors when their tax identity is still “TBD.”

You need statuses like:

If you can’t see this in one place, you’re flying blind.

When someone asks “Do we have the W-9?” you should answer in seconds not start a scavenger hunt.

Don’t improvise. Follow a repeatable playbook.

The IRS points requesters to Publication 1281 for “B” notice procedures and copies of the notices.

At a high level:

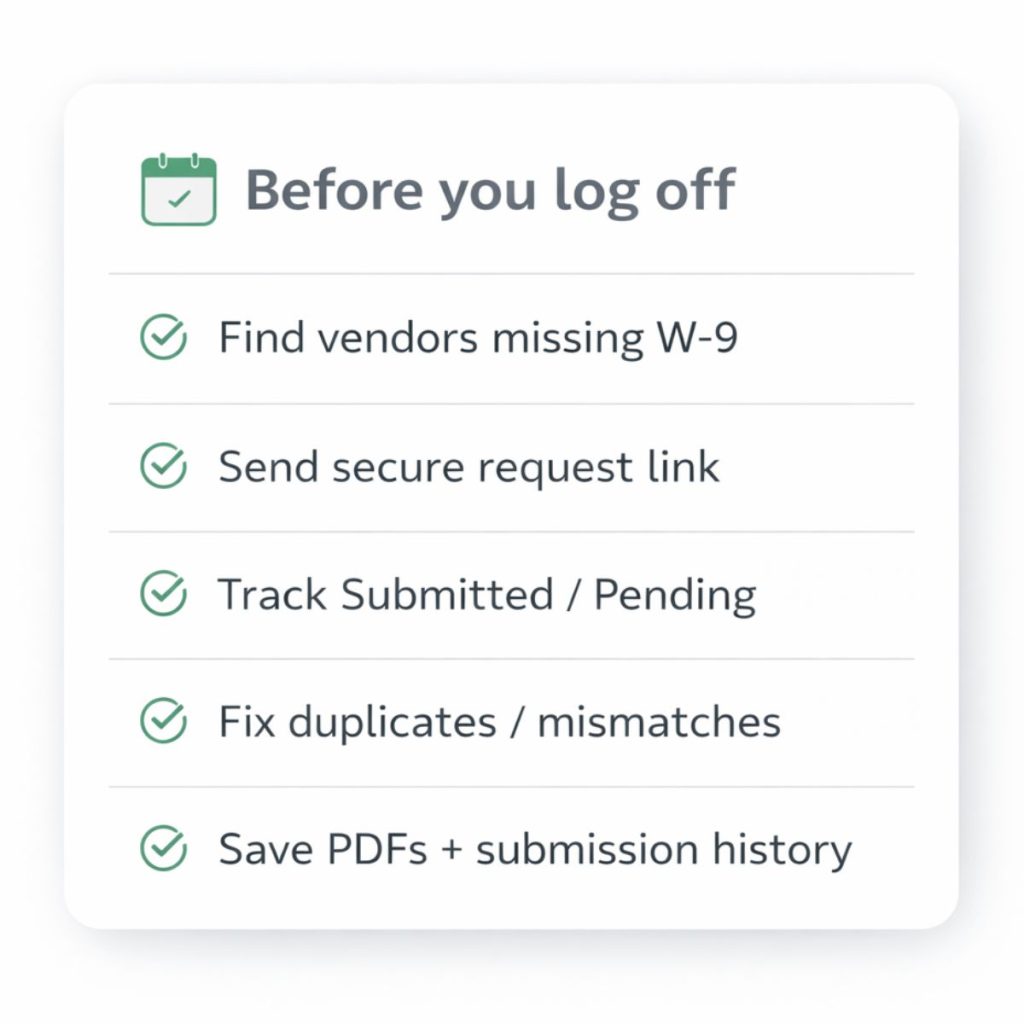

GetW9 is designed to make W-9 collection a process:

That’s it. It replaces inbox chaos with a workflow.

Backup withholding is usually the symptom. Broken vendor intake is the cause.

This week (before you log off), do one thing:

Identify vendors paid this year who don’t have a clean W-9 on file.

If you can’t do that quickly, your process isn’t “fine.” It’s just untested until January tests it.