Physical Address

5206 Hwy 5 N Suite 100, Bryant, AR, United States, Arkansas

Physical Address

5206 Hwy 5 N Suite 100, Bryant, AR, United States, Arkansas

The W-9 and 1099 playbook usually starts the same way: it’s late January, your team is tired, and someone asks a simple question “Do we have W-9s for everyone who needs a 1099?” That’s when the calm disappears. You open the vendor list and see missing forms, duplicate vendors, and names that don’t match what’s on file. Suddenly, you’re not doing accounting work anymore. You’re doing detective work.

And here’s the annoying part: the stress isn’t caused by tax season. Tax season just exposes the gaps you already had.

This post is a clean W-9 and 1099 playbook you can use right after the deadline rush so you don’t repeat the same pain next year.

Let’s talk about “Nina.”

Nina runs AP. She’s sharp. She cares. She follows up.

Still, January turns into a mess.

Here’s what happened:

Nina didn’t fail. The system failed Nina.

This is the core issue: you don’t have one trusted source of vendor truth.

Instead, you have a vendor record, a spreadsheet, an email thread, and a folder called “W9s (new new).”

That’s why this W-9 and 1099 playbook matters.

If you’re still chasing forms right now, read: “Missing W-9s in January? The Late-Filer Survival Guide (With Copy-Paste Email Templates)”

If collecting a W-9 is optional, vendors treat it like optional homework.

Duplicates create confusion, wrong totals, and name/TIN mismatches.

Invoices often show a DBA. The IRS wants the legal name tied to the TIN.

Email is not a filing cabinet. It’s a maze.

When “everyone” owns W-9 collection, nobody drives it to completion.

This is the easiest win.

You don’t even need to start with “no W-9, no pay.”

Start with: we don’t activate a vendor until the W-9 is received (or the correct form if they aren’t a U.S. vendor).

This one rule removes 70% of the January scramble.

Email creates:

Instead, use one request link and track status in one place.

That’s the whole point of tools like GetW9: less chasing, more certainty.

Most teams clean vendor data when panic is already high.

Flip it. Do a cleanup when you’re calm, not when you’re rushed:

Vendors respond when your process is clear.

A simple ladder works:

Keep it polite, but make it real.

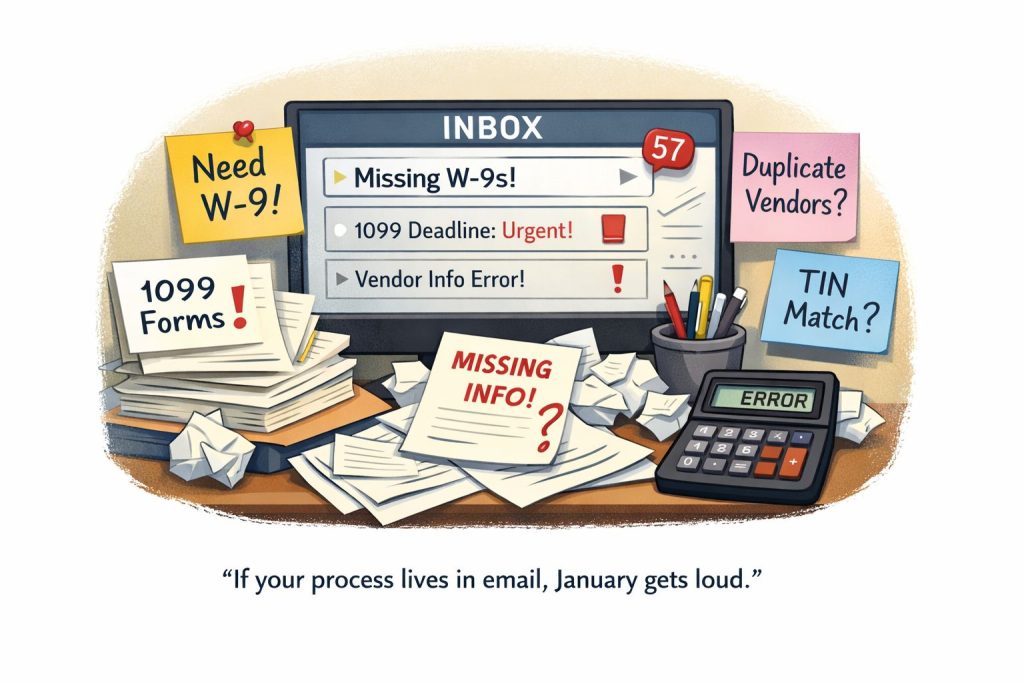

Use this checklist as your “post-season reset.” It’s short on purpose.

This checklist is a core part of the W-9 and 1099 playbook because it turns chaos into steps.

Run this meeting right after the busy week, while the pain is fresh:

Write the answers down. Otherwise, you’ll repeat the same season.

If your W-9 process is spreadsheet + email chasing, you’re choosing stress on purpose.

GetW9 makes the W-9 and 1099 playbook easier to run because it gives you:

The goal isn’t “more software.”

The goal is a process that doesn’t collapse in January.

The teams who stay calm in tax season aren’t “more disciplined.”

They’re more prepared.

Use this W-9 and 1099 playbook now right after the rush so next year you can answer that scary January question without hesitation:

“Yes. We’re good. It’s already handled.”